Payroll Management Services

Managing payroll doesn’t have to be complicated. With our expert QuickBooks Payroll Management Services, you get end-to-end assistance that ensures your employees are paid accurately and on time—every time. Whether you’re a small business or a large enterprise, we help you stay compliant with tax laws, automate payroll tasks, and reduce your administrative load.

Key Features of Our QuickBooks Payroll Management Services

- Direct Deposit & Paycheck Automation

- Multi-State Payroll Processing

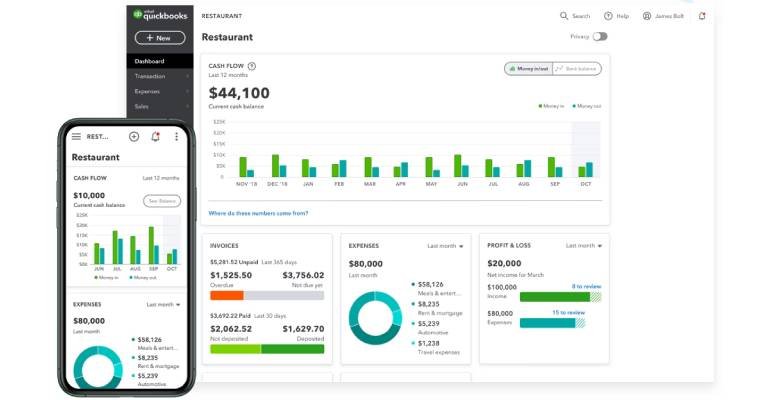

- Real-Time Payroll Reports & Dashboards

- PTO (Paid Time Off), Sick Leave, & Holiday Pay Tracking

- Contractor Payments & 1099 E-Filing

Why Choose Our QuickBooks Payroll Services?

- • Accurate & On-Time Payroll Processing: Avoid costly payroll errors and delays. We ensure every paycheck is calculated with precision, including wages, deductions, and direct deposits.

- • Automated Tax Filing & Compliance: Our team handles all federal, state, and local tax filings, so you never miss a deadline or face penalties. QuickBooks automates the paperwork

- • Employee Self-Service Portal: Give your employees access to pay stubs, tax forms, and benefits—all in one place, reducing HR inquiries and saving time.

- • Custom Payroll Setup & Integration: We tailor the payroll system to your business needs—integrating benefits, time tracking, and third-party software for a seamless experience.

- • Year-End Reporting Made Easy: Get ready for W-2s, 1099s, and all year-end tax documentation with complete assistance.